Are you confused about choosing the right dental insurance plan or what your insurance actually covers? You’re not alone! Navigating the world of dental insurance can be overwhelming, but understanding the differences between PPO and HMO plans is key to making an informed decision. Get ready to unlock the secrets to optimal dental health and find out why your insurance plan could be your best ally in achieving a perfect smile!

Understanding Dental Insurance Plans: PPO vs. HMO

1. PPO – Preferred Provider Organization For Dental Insurance

- Flexibility and Freedom: PPO plans provide coverage through a network of contracted medical providers. Members pay less for care within the network but can also seek care outside the network for a higher cost.

- Direct Access to Specialists: You don’t need a referral to see a specialist, which can save time and provide quicker access to specialized care.

2. HMO – Health Maintenance Organization

- Network Limitations: HMO plans limit coverage to a specific network of health care providers. Members usually need to use providers within that network and often require referrals for specialists.

- Cost Efficiency: Typically, HMO plans have lower premiums but come with more restrictions on which providers you can see.

Why Bauer Dental Center Accepts PPO Plans

At Bauer Dental Center, we accept PPO plans because they align with our commitment to providing quality over quantity. Our focus is on delivering exceptional care, and PPO plans offer our patients the flexibility to choose their preferred providers, ensuring they receive the best possible dental treatment.

PPO Dental Insurance Plans Accepted at Bauer Dental Center

We accept all PPO plans to make your dental care as accessible as possible. Here are the top five popular providers our patients tend to consider:

Making the Most of Your PPO Dental Insurance Plan

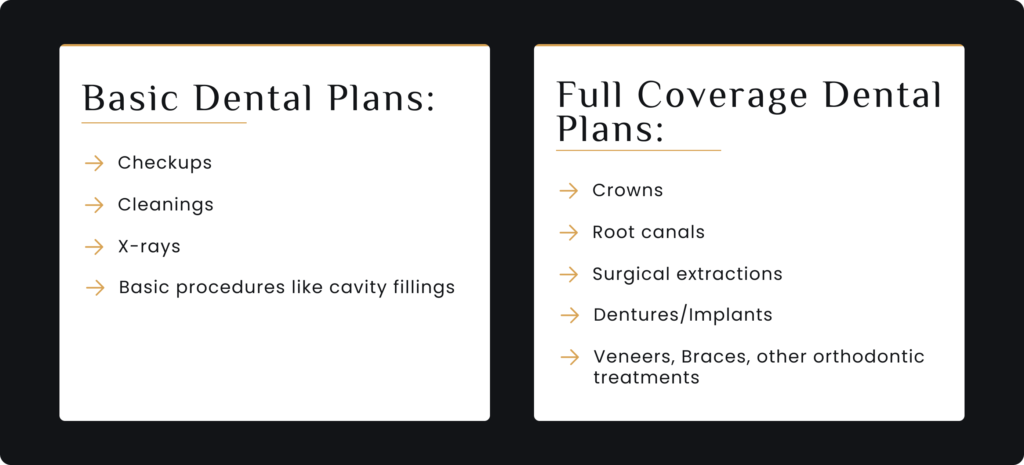

Key Coverage Elements:

- Major Services: some insurance plans cover major dental services like crowns. Some plans have waiting periods or may not cover major services in the first year.

- Annual Maximum: This is the maximum amount your plan will pay for covered services in a year. Higher annual maximums are better, especially if you anticipate needing extensive dental work.

- Waiting Periods: This is the time you must wait after the start date of your policy before you are eligible for coverage on specific procedures. Knowing these limits helps with financial planning for dental care.

- Premiums and Deductibles: Compare the monthly premiums and annual deductibles. Lower premiums might mean higher out-of-pocket costs when you need care.

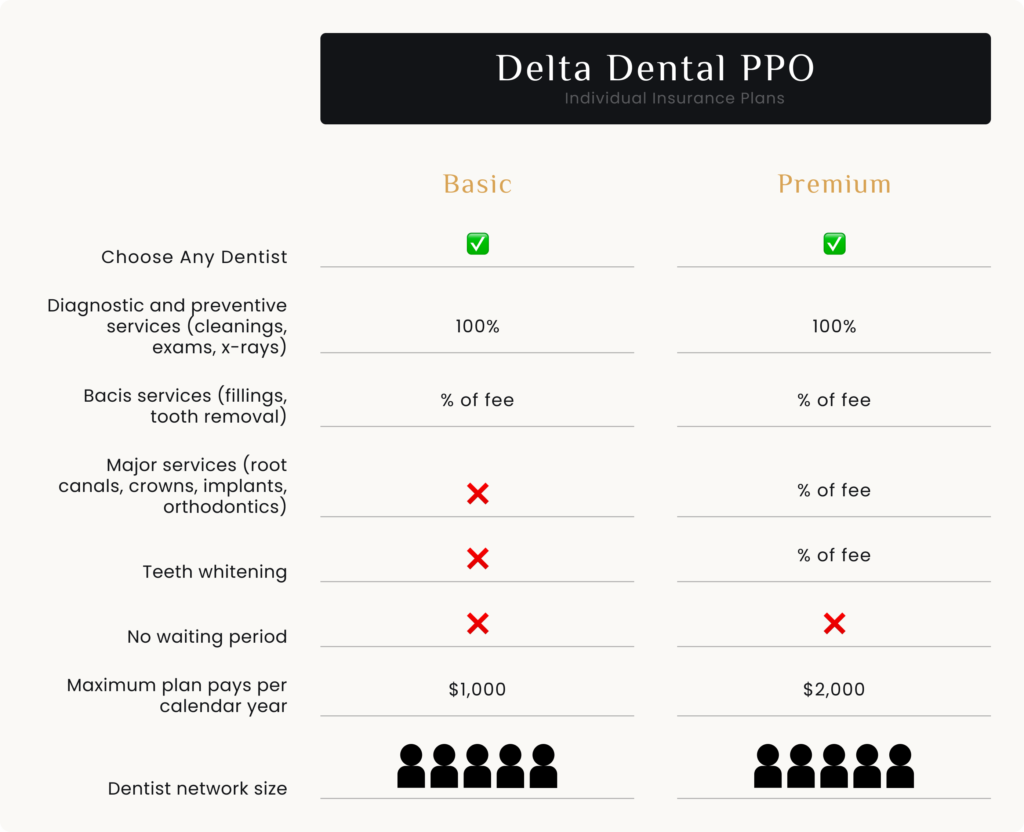

Top PPO Plan Breakdown: Delta Dental

Delta Dental By Plan

Dental Insurance Case Example: Delta Dental Premium PPO

- Procedure Cost: $1,200

- Deductible: $50 per person

- Remaining Cost After Deductible: $1,150

- Coverage Percentage: 50%

- Insurance Pays: $575

- Out-of-Pocket Costs: $625

If you haven’t used any other dental services this year, the insurance payment of $575 will be subtracted from your annual maximum.

Why Choose a PPO Plan?

- Greater Flexibility in Provider Choice: PPO plans offer the freedom to see any healthcare provider without needing a referral.

- Out-of-Network Coverage: Provides some level of coverage for out-of-network care, though at a higher cost.

- Direct Access to Specialists: Allows direct access to specialists without needing a referral from a PCP.

- Higher Coverage Limits: Typically have higher annual maximums and out-of-pocket limits for covered services.

Conclusion

Understanding your dental insurance options is crucial for making informed decisions about your dental care. PPO plans offer the flexibility and coverage needed to ensure you receive the highest quality care from your preferred providers. At Bauer Dental Center, we’re committed to helping you navigate your insurance options to achieve the perfect smile. If you have any questions or need further assistance, don’t hesitate to contact our office.